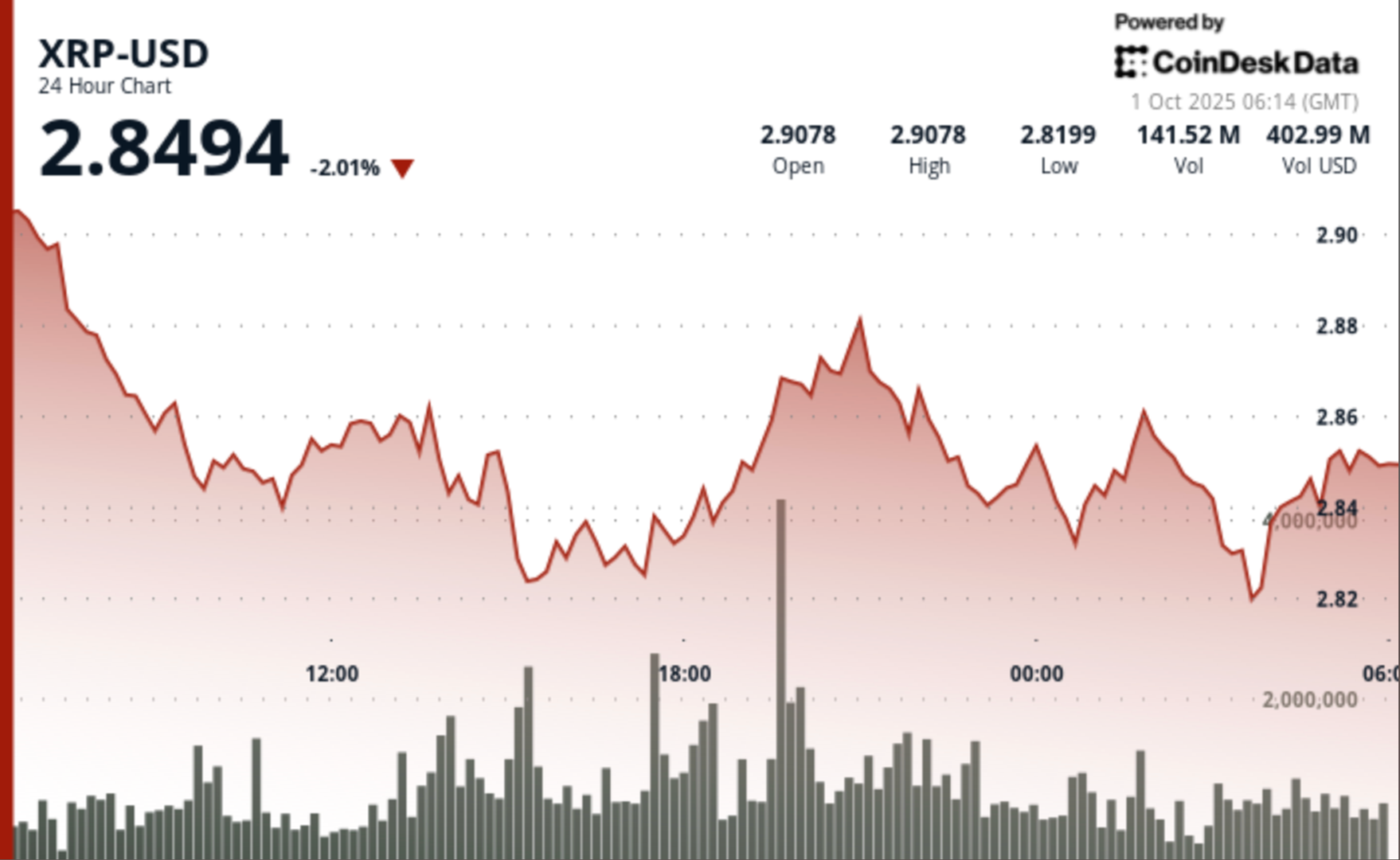

XRP traded inside a compressed $0.09 corridor after an early push to $2.91 was met with sharp profit-taking. Buyers defended the $2.82–$2.84 zone, leaving the token consolidating at $2.85 into the close as volumes tapered. Analysts flagged bearish divergences while reserves rose on Binance, raising caution ahead of the $3.00 test.

News Background

- XRP has seen inflows of more than $6 billion over two days, driven by treasury adoption and speculative positioning.

- Regulatory focus sharpened as reports flagged zero corporate buy orders on Binance despite rising reserves.

- Wall Street technical desks advise caution until a breakout above the $3.00 threshold confirms trend direction.

Price Action Summary

Aggressive buying pushed XRP to $2.91 at 06:00 on 49.8 million in volume.

Profit-taking cut price back to $2.82–$2.84, with turnover well above the 24-hour average of 56.8 million.

Stabilization in a $2.85–$2.86 band, with volume thinning to 4.9 million.

Market cap closed near $2.85, consolidating gains but failing to retest session highs.

Technical Analysis

- Resistance hardened at $2.91 on heavy rejection volume.

- Support validated at $2.82–$2.84 with multiple buy spikes.

- Breakout through $2.85 at 01:43 on 1.5 million tokens signaled algo-driven demand.

- Late-session consolidation shows reduced selling pressure but weak conviction.

- Divergences forming on momentum indicators cap upside risk in near term.

What Traders Are Watching

- Can XRP reclaim $2.91 and close above $3.00 to flip resistance?

- Impact of Binance’s 19% reserve increase and whether inflows represent sell-side liquidity.

- Regulatory scrutiny around exchange behavior and reported lack of corporate bids.

- Fed’s dovish tone on rates as a tailwind for Q4 crypto flows.